As part of our quantitative trading approach, we are maintaining two comprehensive datasets of historical intraday short sale availability across a broad universe of assets.

Initially developed strictly for internal research, these datasets are now available for purchase to institutions, academics, and independent researchers. Since we record short sale availability on all US traded stocks and over 500 Cryptocurrencies, but only trade a fraction of them, much of the data remains untapped — and could potentially be valuable to others.

Please refer to our GitHub repository, which includes research examples along with both processed and raw dataset samples.

If you’re conducting research in this area and would benefit from access to granular intraday historic short availability data, we invite you to contact us for specific details. A general description of our offering and it’s value (along with samples) are highlighted below.

Note: Short availability data (which is our unique offering) is often confused with short interest data, but the two are fundamentally different.

Short Availability (Our Offering)

Short availability refers to the number of shares available for borrowing at a given time, for short selling. It fluctuates based on supply and demand in the securities lending market. A lack of available shares to borrow can create a supply constraint, often causing the asset to trade at a premium.

Short Interest

Short interest represents the total number of shares that have already been sold short but not yet covered or closed out. It is typically expressed as a percentage of total shares outstanding.

We have found Short Availability to be of critical value for two key reasons:

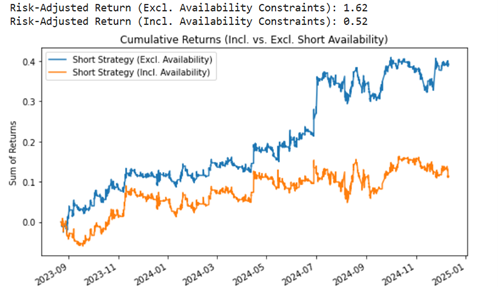

- More Realistic Backtesting

- Assuming an asset can always be shorted during opportune moments is a naive assumption that can inflate backtest results.

- Incorporating point-in-time historical short availability data corrects this.

- See the chart below, which highlights the isolated impact of incorporating short availability constraints in a short-only strategy backtest.

- Source of Alpha

- Since short availability affects supply and demand, it can be integrated into models to extract alpha, see our research below for ideas on this

We have created a notebook with detailed explanations, walkthroughs, and example applications to help you incorporate this data into your research.

Key Dataset Information

- U.S. Stocks Historical Short Availability, Short Fees and Rebates

The number of shares available to be shorted at a world leading prime broker. This is not a consolidated total number of shares available to short in the whole market.

- Coverage: All U.S. stocks (survivorship bias-free)

- Data since: August 2023 – Present

- Frequency: Every 15 minutes, 24/7 (including outside regular trading hours)

- Quality: 95%+ uptime (minor gaps due to downtime)

- Source: Leading prime brokerage institution

- Crypto Short Availability

The quantity of all USDT and USDC denominated cryptocurrencies available to be shorted on Binance.

- Coverage: All USDT-denominated cryptocurrencies (survivorship bias-free)

- Data since: June 2024 – Present

- Frequency: Every 5 minutes (24/7)

- Quality: 95%+ uptime (minor gaps due to downtime)

- Source: Binance (real-time public data, historically recorded by us)